interest tax shield calculator

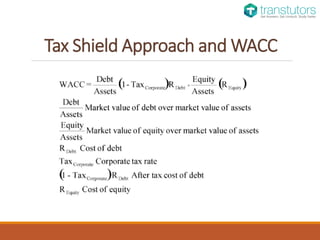

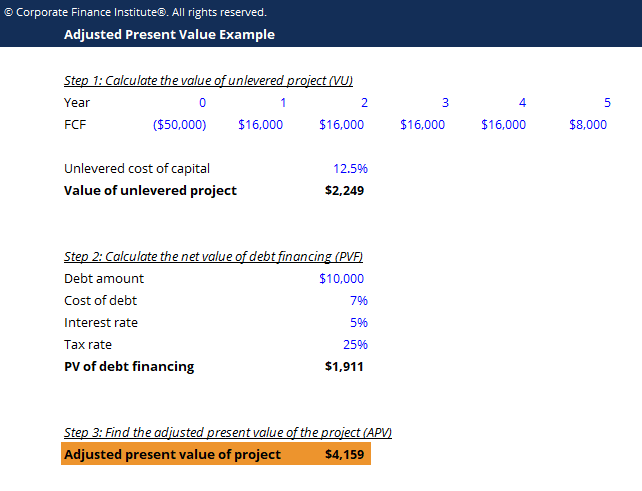

How to calculate the tax shield. The adjusted present value is the net present value NPV of a project or company if financed solely by equity plus the present value PV of any.

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Tax-Deductible Interest Amount Tax Rate.

. Interest Tax Shield Average debt Cost of debt Tax rate. Those deductions lower the company or. So the total tax shied or tax savings available to the.

Adjusted Present Value - APV. The impact of adding removing a tax. The intent of a tax shield is to defer or eliminate a tax liability.

The tax rate for the company is 30. Interest Tax Shield is defined as follows. Interest Tax Shield Definition The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate.

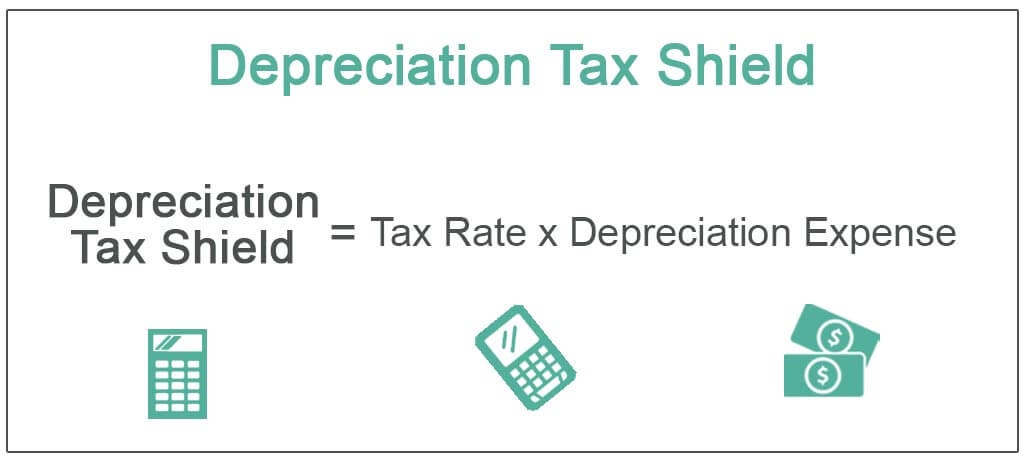

Cash Outflow in Year 1 Annual repayment Depreciation. To calculate the value of the interest tax shield you may use this interest tax shield calculator or estimate the value manually as we do in the following example. It is possible to calculate the value of a tax shelter by multiplying the entire amount of taxable.

Interest Tax Shield Definition The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. For instance if your allowable interest tax cost is 2000 and the effective tax rate is 25 then your interest tax shield will be. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedTax shield can be claimed for a charitable contribution.

The extent of tax shield varies from nation to nation and as such their benefits also vary based on the overall tax rate. Interest Tax Shield 3500 2500 125100. A tax shield is a reduction of taxable income due to decreasing it by deductible expenses like interest amortization and depreciation.

This companys tax savings is equivalent to the interest payment multiplied by the tax rate. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900.

Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. For instance if the tax. This is equivalent to the.

How to Calculate Adjusted Present Value APV Since the additional financing benefits are taken into account the primary benefit of the APV approach is that the economic benefits stemming. What is the formula for tax shield. This can lower the effective tax rate of a business or individual which is especially important when their reported.

02022022 By Carol Daniel Legal advice. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest medical expenditure charitable donation. Formula to Calculate Tax Shield Depreciation Interest The term Tax Shield refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed.

As such the shield is 8000000 x 10 x 35 280000. Basically the company uses two main tax shield strategies. For instance if the tax.

Tax Calculator Return Refund Estimator 2022 2023 H R Block

All About Online Income Tax Calculator

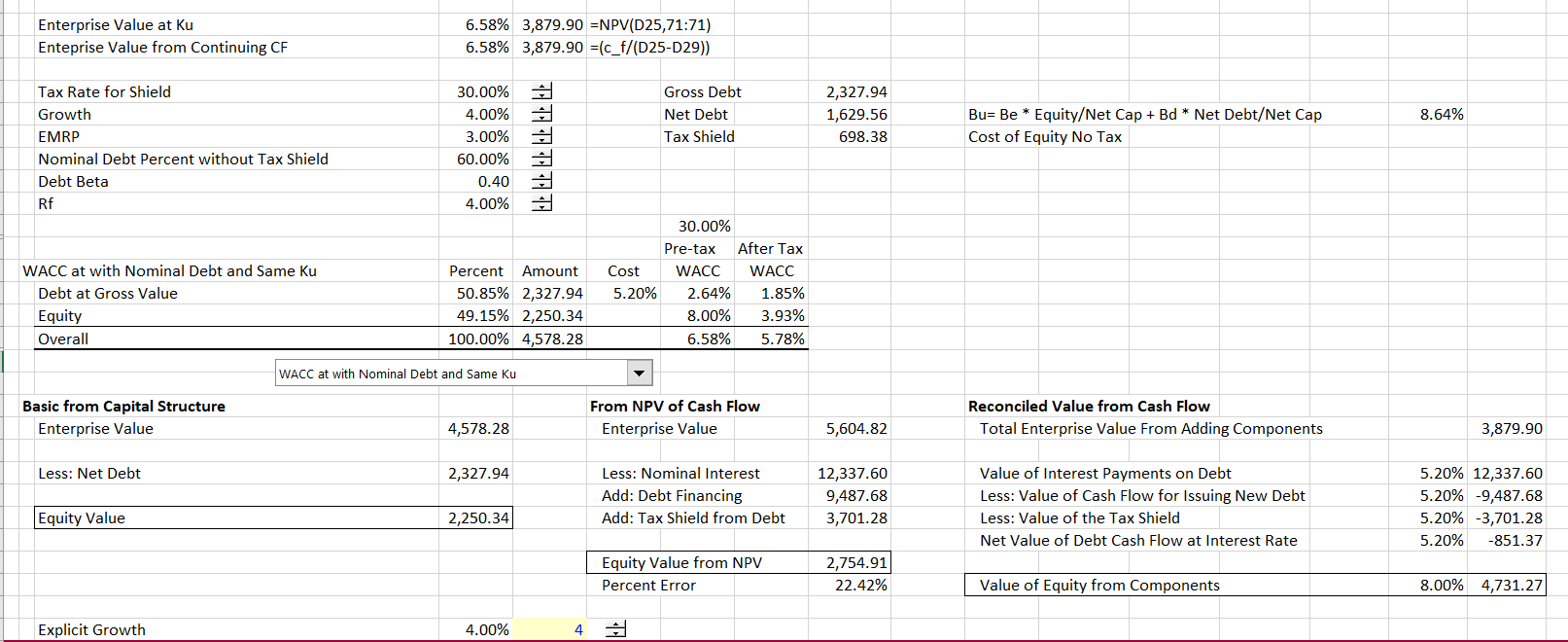

Wacc Adjustment To Correct Valuation Of Tax Shields Edward Bodmer Project And Corporate Finance

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Depreciation Tax Shield Formula Examples How To Calculate

Adjusted Present Value Template Download Free Excel Template

Pdf The Present Value Of The Tax Shield Pvts For Fcf In Perpetuity With Growth

Tax Shield Formula Step By Step Calculation With Examples

How To Calculate Total Interest Paid On A Car Loan 15 Steps

Excel Finance Class 83 Estimating Cash Flows For Npv Calculation Youtube

Interest Tax Shield Formula And Calculator Step By Step

Wacc Formula Calculator Veristrat Llc What S Your Valuation

Tax Shield Definition Formula For Calculation And Example

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

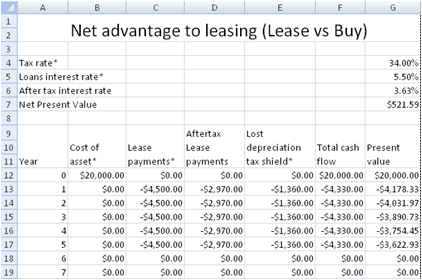

Free Lease Or Buy Calculator Net Advantage To Leasing

Beta And Leverage Management In Corporate Finance Lecture Slides Slides Corporate Finance Docsity